Recurring payments have been around for centuries but gained popularity with the rise of the Internet. Now, they are becoming increasingly popular online and are used in a wide variety of eCommerce applications and products.

As of today, some marketplaces cannot survive without recurring payments. In this article, we’ll learn about them, as well as the difference between a recurring payment and an installment payment, and how to add this feature to WooCommerce if it’s missing.

For example, you want to sell your magazine on WooCommerce by subscribing customers for $10/month, automatically charged to their preferred payment method. How to do this? We’ll explain how later, but first let’s talk about recurring payments.

Table of contents

What are recurring payments in WooCommerce?

What exactly are recurring payments? This sales model involves customers subscribing to a service that requires them to make regular payments. The frequency of these payments differs based on the specific case. These payment details can be charged daily, weekly, monthly, annually, or even over extended periods (in our example, monthly).

Do not confuse recurring payments with installment payments. Installment payments allow you to divide a total amount into several payments over time. However, recurring payments are only made until the total amount due is paid off.

Actual recurring payments, on the other hand, typically do not involve termination unless the customer cancels them. They can be associated with services as well as products that are provided for the duration of the subscription period, maintaining a fixed cost unless the contract changes.

Who uses recurring payments?

In terms of usage, we only need to look around us and our spending to notice many cases of recurring payments. Let’s take a few examples:

- Streaming Services – like Netflix, Disney+, Hulu, and others use this approach to keep the service running over time. A single initial payment wouldn’t be enough to sustain this business model.

- Banks – Most banks have a recurring fee, either monthly or annually, for managing their customers’ checking accounts. This fee is widely accepted and used globally.

- Connectivity and phone services – Most phone companies today charge a monthly fee that covers all functions, including calls, messages, and internet usage. In the past, rechargeable cards with variable costs based on usage were common. However, internet companies also follow this monthly recurring charges system. Unlike other bills, this cost is not based on consumption but is a fixed charge.

- eLearning Platforms – Instead of selling a course, many companies offer subscription products to maximize revenue, retain customers over time, and provide ongoing services to their customers.

- Promotional subscriptions – The most visible case is Amazon Prime, which is used by most customers who make regular purchases from the eCommerce giant. Customers pay a monthly or yearly fee to receive many benefits, including fast and free shipping.

- Rent and Condo – Surprising as it may seem, the same rent and condominium expenses are among the recurring payments, as they are costs applied with fixed recurrence and of the same value.

- Newspaper and magazine subscriptions – Just like the case discussed in this article, many online newspapers require a monthly payment from their readers (such as Corriere dello Sport).

Of course, there are many other examples, but we can divide recurring payments into two groups: services and products that rely entirely on this payment model and cannot exist otherwise, and stores that use recurring payments to have a fixed and predictable income each month while offering additional or premium services.

Recurring payments created a $13 trillion market in 2023, which will continue to increase by 17% in the next four years, according to research from Juniper Research. Don’t underestimate this tool’s potential.

So why are people so attracted to automatic and recurring payments? There are many benefits: from the continuity of a service, to the ease of use (since they are truly automatic and do not require manual authorization each time), to the perceived convenience in the short term despite the large flow of money they can generate over time.

From a seller’s perspective, it is easy to see the power of this tool and where it can be used, but how do you go about using this feature in WooCommerce? Let’s find out together!

Implementing recurring payments with WooCommerce

Can WooCommerce accept recurring payments? Unfortunately, the answer is no, at least not without using a special plugin. In fact, WooCommerce allows credit card and PayPal payments (a prerequisite since automating recurring payments can only be done through similar methods), but you will need to use the WooCommerce Subscription plugin to create recurring payment plans.

Warning: Many people confuse how Subscription works with WooCommerce Membership, as they are often used together. The former allows you to create recurring payments, the latter allows you to associate premium content with a specific purchase. To give an example, if you wanted to replicate the Amazon Prime subscription on your site, Subscription would allow you to create the monthly or annual payment, and Membership would allow you to create exclusive content (such as a Prime Video section) and free shipping and associate it with the Prime purchase. This article details how to create subscriptions models like Amazon Prime.

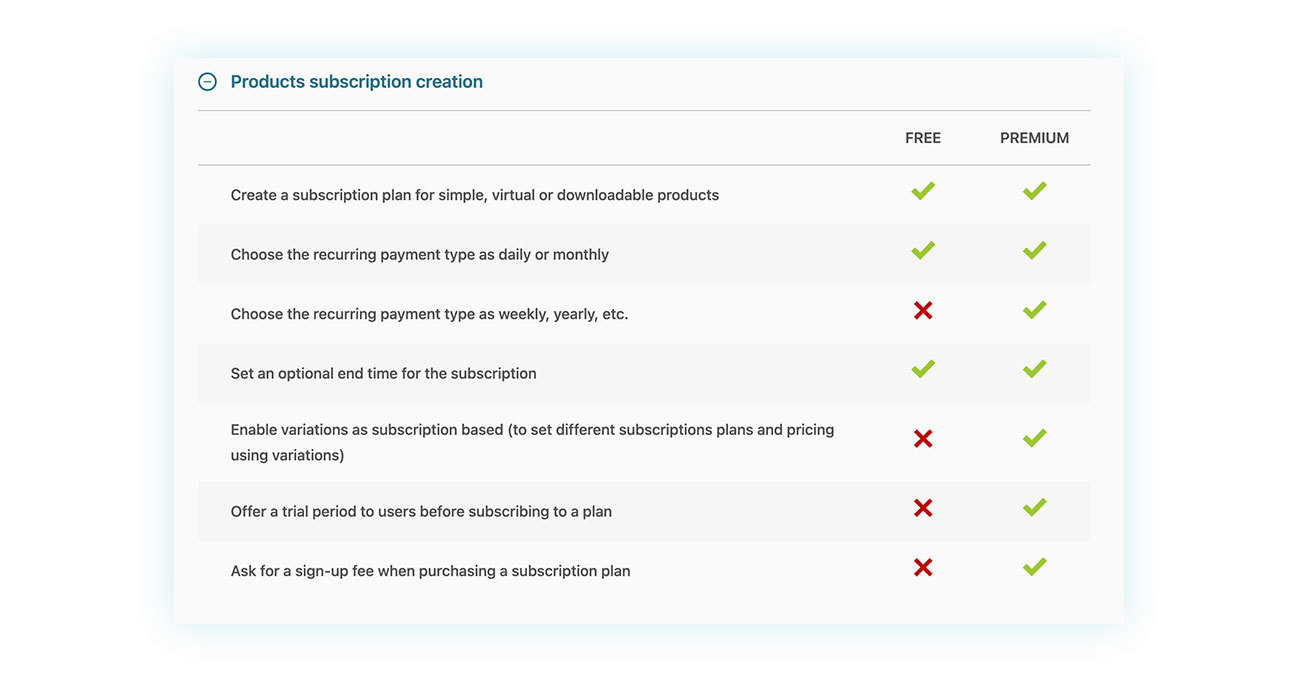

Coming back to the Subscription plugin, you will be happy to know that it is really simple and intuitive. Moreover, it comes with both a free and a premium version, in case you want to touch some of its features.

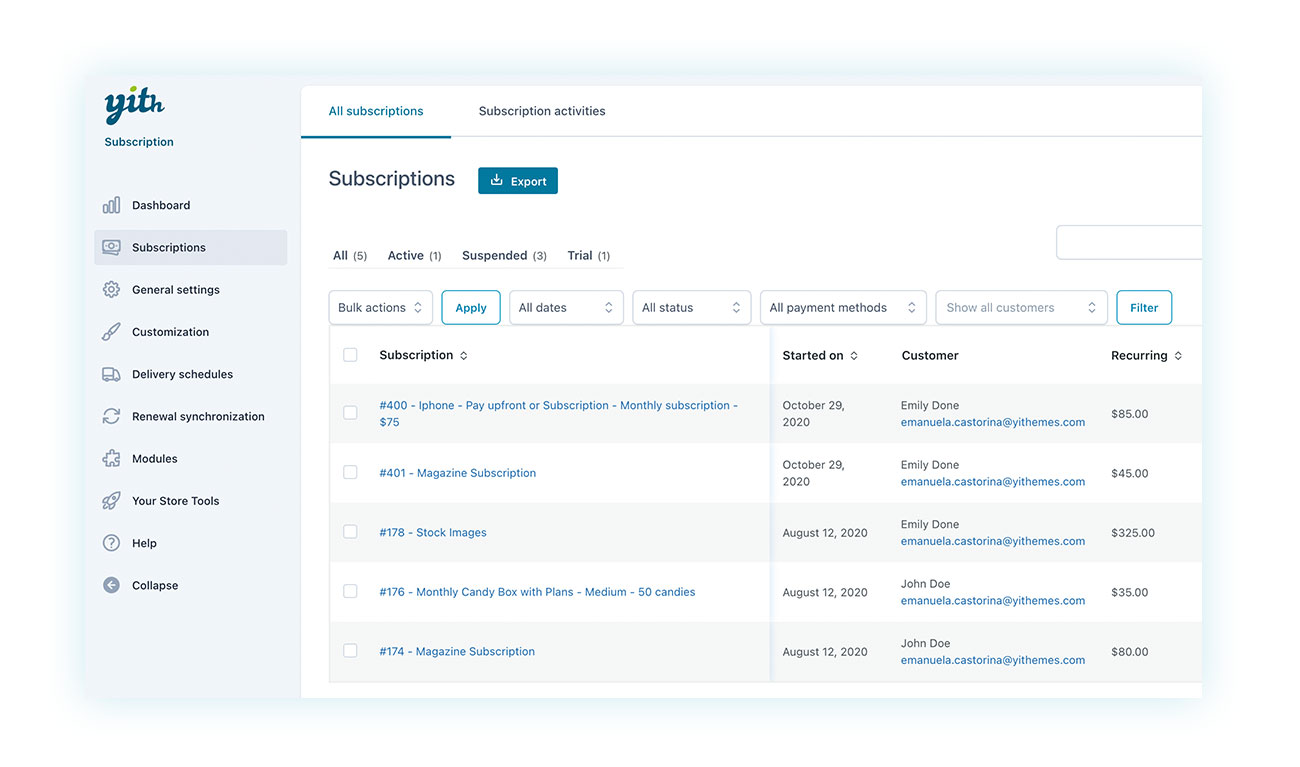

To use the plugin, you need to download its zipped folder and upload it to your WooCommerce site. After activating the plugin from your WordPress dashboard, another dashboard will display all subscriptions made on your site:

Also on this page, you can choose how the plugin behaves in response to customer actions. For instance, you can decide whether customers can buy multiple subscriptions at once, or if they can use payment gateways that don’t support automatic payment. You can find these options under the “General Settings” tab:

Speaking of payment gateways, which ones are used by Subscription?

Which payment gateways to use?

As mentioned earlier, you can choose any payment gateway for manual customer renewal. However, this option is less efficient than automatic renewal because most people either pay late or do not pay at all (constantly reminding the customer to renew increases the risk that they will reconsider their purchase).

There are many solutions that can handle renewals of different payments automatically and easily:

In this comparison table, you can also find all the other plugins offered by YITH for managing automatic recurring payments, and as you can see, most of the digital solutions completely cover their recurrence. Among them you can find PayPal, Stripe, Amazon Pay, WooCommerce Payments and much more.

How to set up recurring payments

Ok, we’ve covered everything about this plugin. Now, how can I offer my magazine as a monthly subscription?

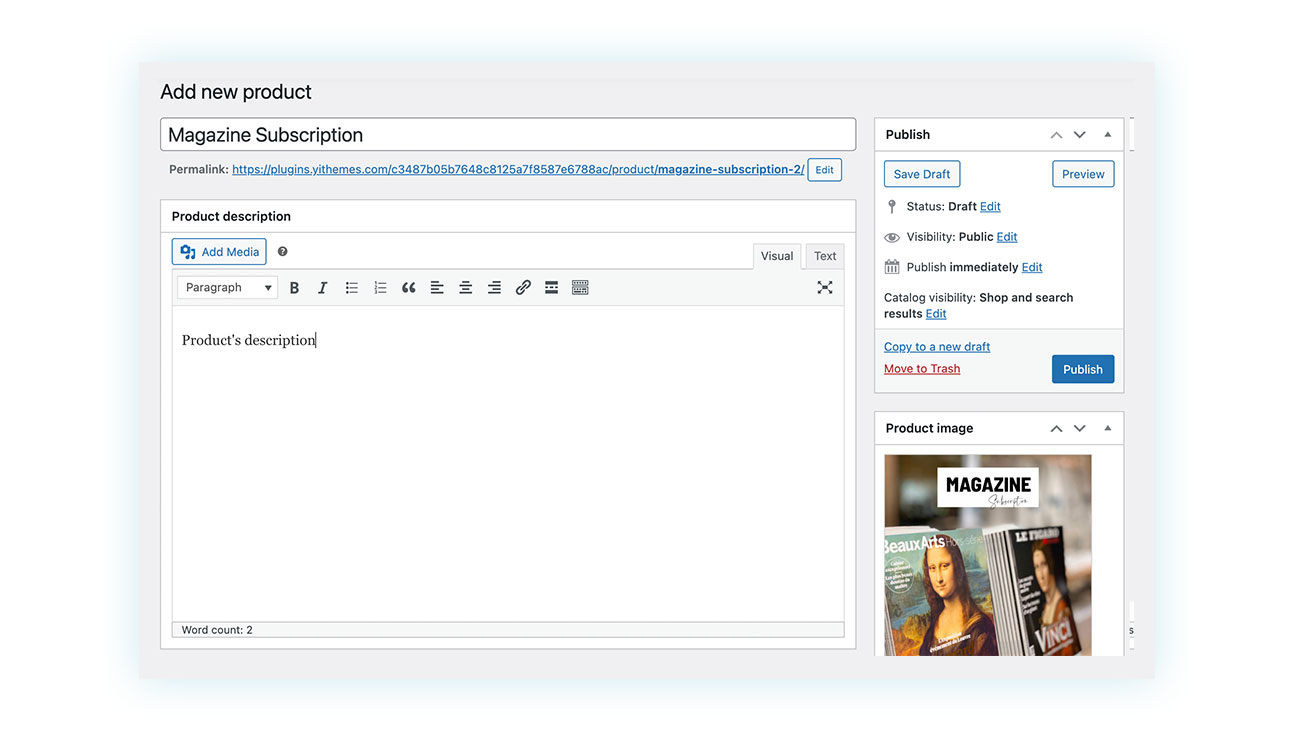

All you need to do is create a new product in WooCommerce like you normally do.

As you can see, we added the name of the product, a description, and an image. At this point, we will move to the bottom of the Product Data section:

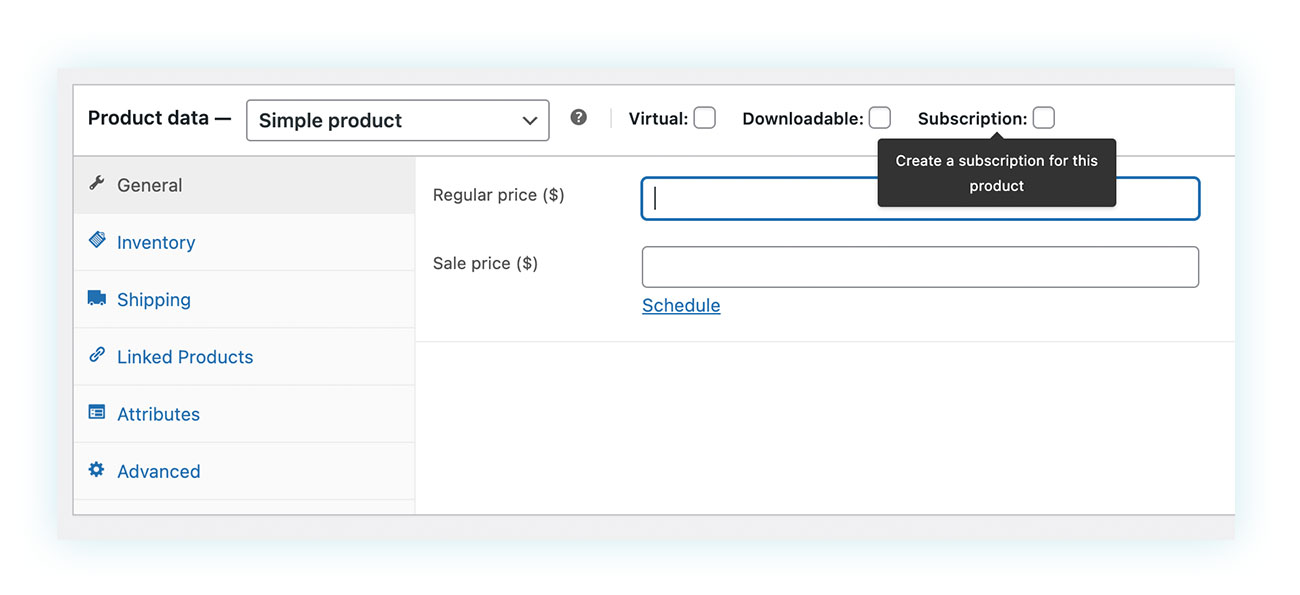

After activating the plugin, a new checkbox titled “Subscription” will appear. By selecting it, a new “Subscription Settings” tab will appear on the left side. But before we do that, we need to enter the subscription price we want to set, which is $10:

Let’s go to the Subscription Settings tab now.

As you can see, there are several important options on this tab. Lets have a look at them together:

- Payment Frequency – Determine how often to charge the client’s account.

- Subscription duration – You can choose to have the subscription expire after a specified period of time or continue indefinitely until canceled by the customer (most subscriptions fall into the second category).

- Trial period – Decide whether to offer a trial period before the first payment is charged.

- Application fee – If you require payment of an initial amount at the time of subscription.

And more. For our specific example, we are interested in the first two options: the subscription should have no expiration date and be billed once a month.

The fee will be charged on the same day every month. Our magazine is complete, and this is how it will look to our customers:

Management of recurring payments

Accepting recurring payments have great potential, but remember that it is a unique business model. Pay attention to different elements compared to regular transactions.

So, what should we pay attention to?

First, consider when subscription payments fail. In an ideal situation, your renewal payments will always go through without a hitch, but in reality this is not the case. So, what actions should you take if a renewal doesn’t happen?

- Notify the customer quickly – In most cases, a renewal fails not because of the customer’s decision but because of lack of attention. The reason could be insufficient funds or an expired card. It’s important to inform the customer promptly of the subscription status, as it increases the likelihood of recovering the payment. Cancelling the subscription immediately does not ensure the customer’s return in the future.

- Do not hinder cancellations – We understand that you want to minimize the cancellation of your recurring payments, but we advise against actively discouraging customers from doing so. That includes hiding the cancellation button on pages that customers don’t regularly access. You need to find a balance between preventing cancellations and making them easily accessible. Being transparent is better than making your users uncomfortable or dissatisfied. The unsubscribe button should be in newsletters, even if there is no money involved or an actual subscription.

- Communicate with your clients – Leave a direct line of communication open so that any problems, concerns, or doubts can be addressed. This method can prevent most cancellations.

- Offer multiple payment options – As you saw before, there are multiple methods you can use to automate recurring payments. You don’t need to use all of them on your site, but be sure to cover most of the ones that are most popular in your country to increase the chances of an automated subscription.

- Keep track of renewals – It’s easy to see the number of site renewals (YITH WooCommerce Subscription provides this data in your dashboard), so it’s crucial to keep track and check regularly. If renewals drop from the previous period, it’s important to find out why and take action to fix it.

Conclusion

Creating products with recurring payments on a WooCommerce store is quick, simple, and easy to use.

Whether your business is entirely built around this feature, or you just want to add subscriptions to a classic store, Subscription is the plugin for you!