As with any self-respecting sales system, WooCommerce also offers its own payment gateways. These tools range from functions integrated with the platform to others that can be added by means of dedicated plugins. In this article, we’ll give you a comprehensive overview of the various payment gateway options you can offer your customers for them to use at checkout on your online store.

What are Payment Gateways?

Let’s start with a simple definition. A payment gateway is a function that allows you to accept an online payment by sending information to the associated service and receiving confirmation of a successful transaction. With a payment by bank transfer, for example, a manual confirmation of the receipt of the money has to be provided. But when a payment is made using a credit card or a digital wallet (such as PayPal), you will need a tool that acts as a bridge, connecting your site with the customer’s bank or payment service.

Table of contents

- What are Payment Gateways?

- How do payments work in WooCommerce?

- How to change payment method in WooCommerce?

- How to add payment methods to WooCommerce?

- How to accept credit card payments?

- What is the best WooCommerce payment gateways?

- How can I make recurring payments with WooCommerce?

- How to reduce payment gateway fees

- How to limit payment methods in WooCommerce?

- FAQ

- Conclusion

How do payments work in WooCommerce?

In our article on setting up WooCommerce, we looked at the traditional payment methods the platform provides by default. There are three types of “old school” ways to get paid. These are:

- Wire transfer

- Payment by cheque.

- Cash on delivery

Not only do these methods make things difficult in terms of slow processing speed and inconvenience for the customer: they simply aren’t the best solution for online sales. Most people prefer using more up-to-date, instant systems, such as credit cards or PayPal. But how much of a difference does using these methods actually make to you?

According to SalesLion, stores that accept PayPal have a conversion rate of 88.7%. That’s a whopping 82% more than other checkout types (including credit cards)! Why is that? Well, it’s mainly because PayPal is a very well established player in the market, creating an immediate sense of trust in the customer. Not only has the service co-founded by Elon Musk been around for years, it also allows you to pay without exposing your credit card details when you shop online.

Of course, this doesn’t mean that you should just ignore the credit card checkout: ideally, these two methods should be offered as alternative payment options. This will help achieve the best possible conversion rate, turning the highest number of users of your site into paying customers.

How to change payment method in WooCommerce?

OK, so now we’ve reached the point where you’re ready to customize each payment gateway for your site. There are two ways of doing this:

- Simply remove and/or deactivate the methods you don’t want to offer

- Add those you think to consider necessary.

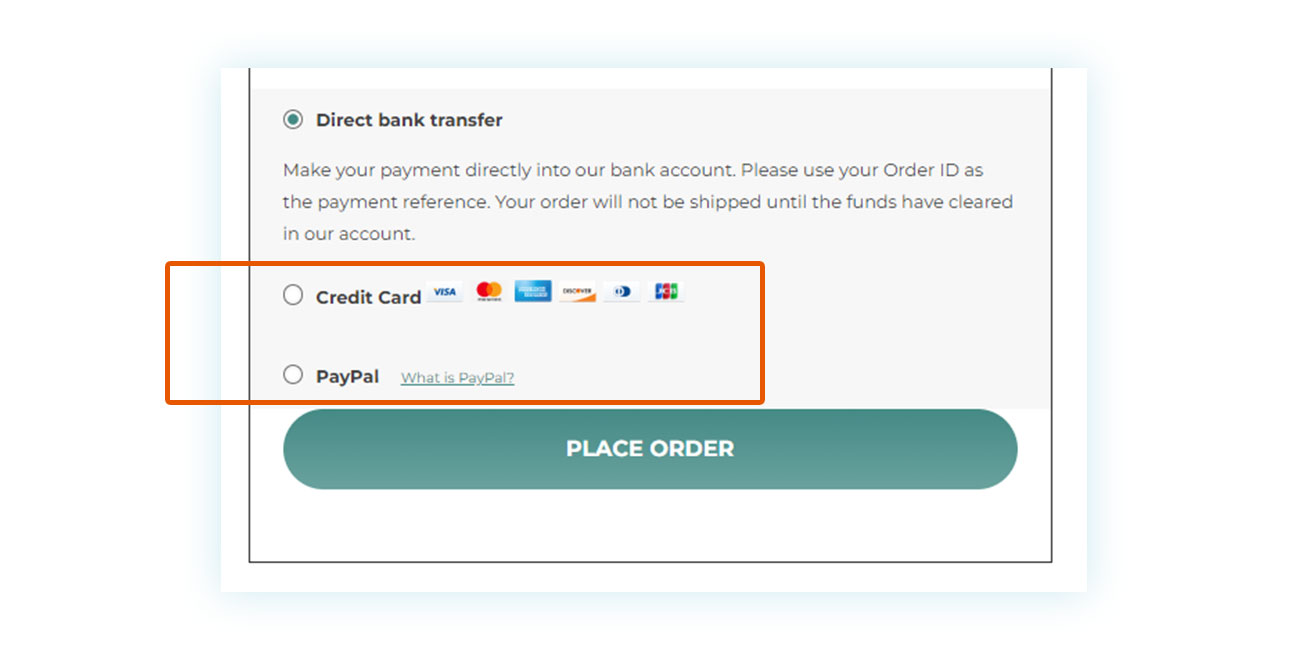

To make this guide easier, we’ll remove the original payment methods, leaving only bank transfer as an option. Then we’ll add in all the additional online ones you can offer.

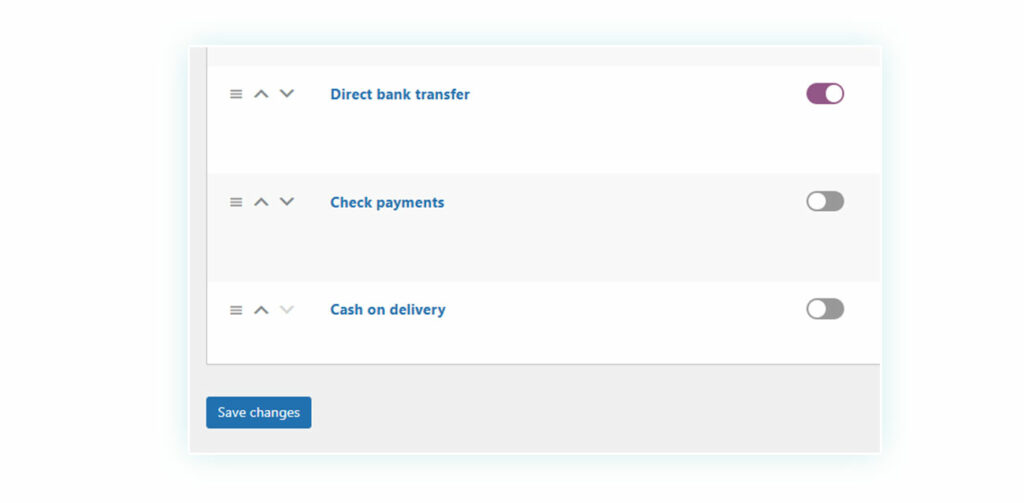

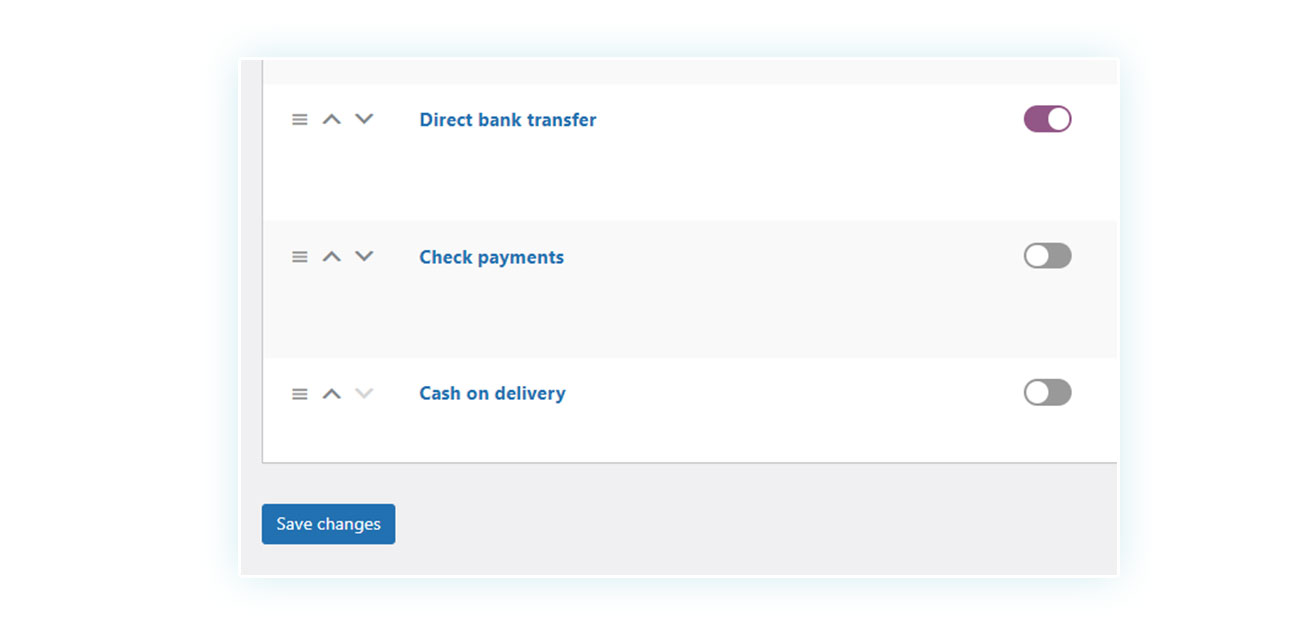

Let’s start by removing the payment gateways that we don’t want to accept. Go to WooCommerce > Settings > Payments.

Here you can check the option to activate or deactivate a payment method. The option is greyed out (not available) when the method is deactivated and is purple when it’s active. If we want to leave only the bank transfer option, the screen will look like this:

If you use the default settings, your WooCommerce online store will only accept payments made by bank transfer. So, you obviously need to include some additional methods. To do this you can use one or more plugins: WooCommerce itself recommends using the built-in WooCommerce Payments, but there are also other dedicated plugins you can choose. Below, we will suggest a specific plugin for each payment method you want to add.

How to add payment methods to WooCommerce?

Once you’ve removed the payment methods you don’t want, it’s important to understand how to add a plugin to your WooCommerce site. The standard WordPress process, however, won’t work with plugins you have bought separately.

Normally, all you have to do is go to Plugins > Add New and then use the appropriate search bar to find the plugin you need. However, you will only be able to access the free versions of the plugins, which are usually not recommended for WooCommerce payment methods.

In addition to having fewer features, the free versions don’t benefit from direct technical support, which is handy if you run into any problems. When it comes to payments, it’s always good to be able to count on the professional support and expertise of the plugin’s development team.

When you buy the plugin it comes as a .zip file. You need to upload this .zip file to your WooCommerce store. Go to Plugins > Add New > Upload Plugin and upload the .zip file directly from your PC, without unzipping it.

How to accept credit card payments?

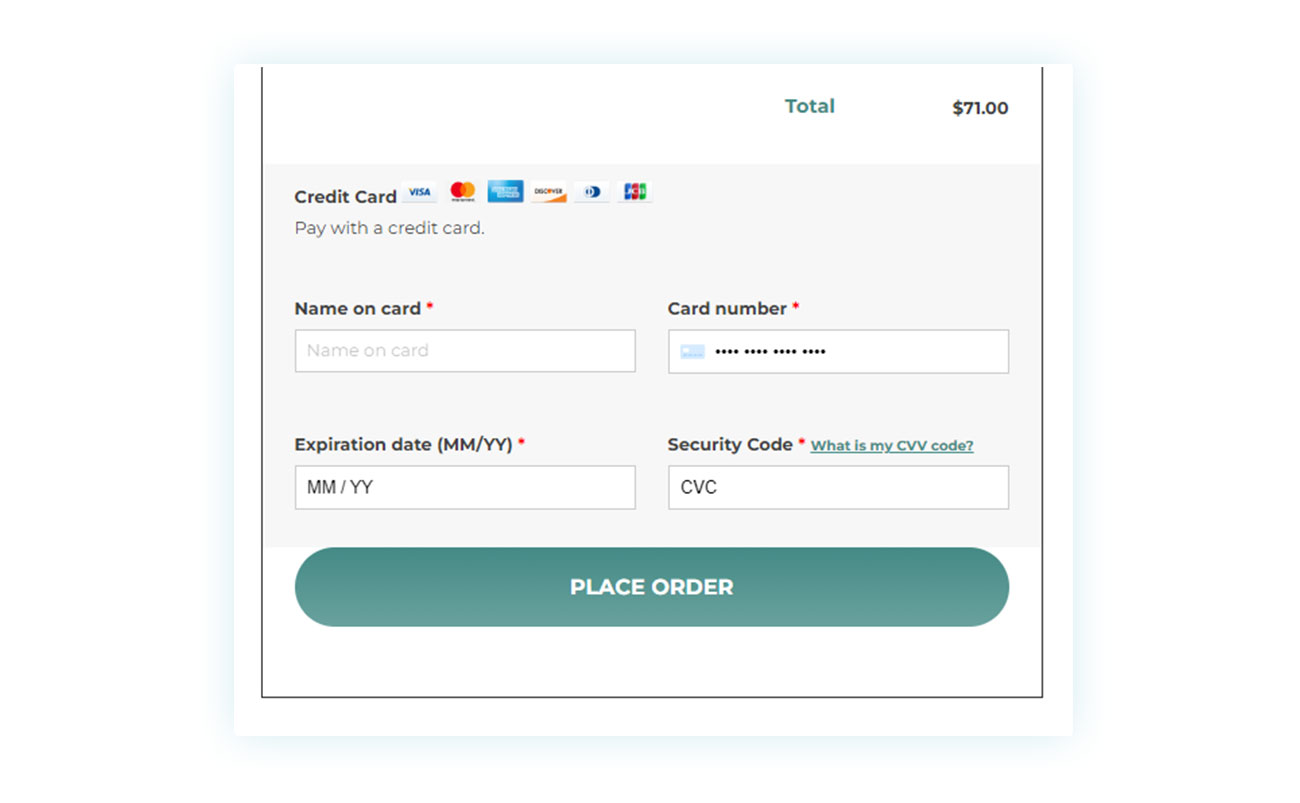

Let’s start with credit cards, as they are one of the most popular online payment methods – and an option which your customers often cannot do without. In order to allow credit and debit card payments, you will need to use a plugin called WooCommerce Stripe.

Stripe is the most widely-used online service for processing card payments and acts as an intermediary between the customer and the bank. Payments made this way will be sent to your (personal) Stripe account. You can easily move the money to your bank account when you feel like it.

Once you have installed the plugin, you need to create your Stripe account: this not only gives you an online account where your customers’ payments will be credited; you will also be able to obtain the key necessary to make the plugin work from your account.

When you set up the service, you will be asked for an identification key that tells the plugin exactly which Stripe account it should connect to.

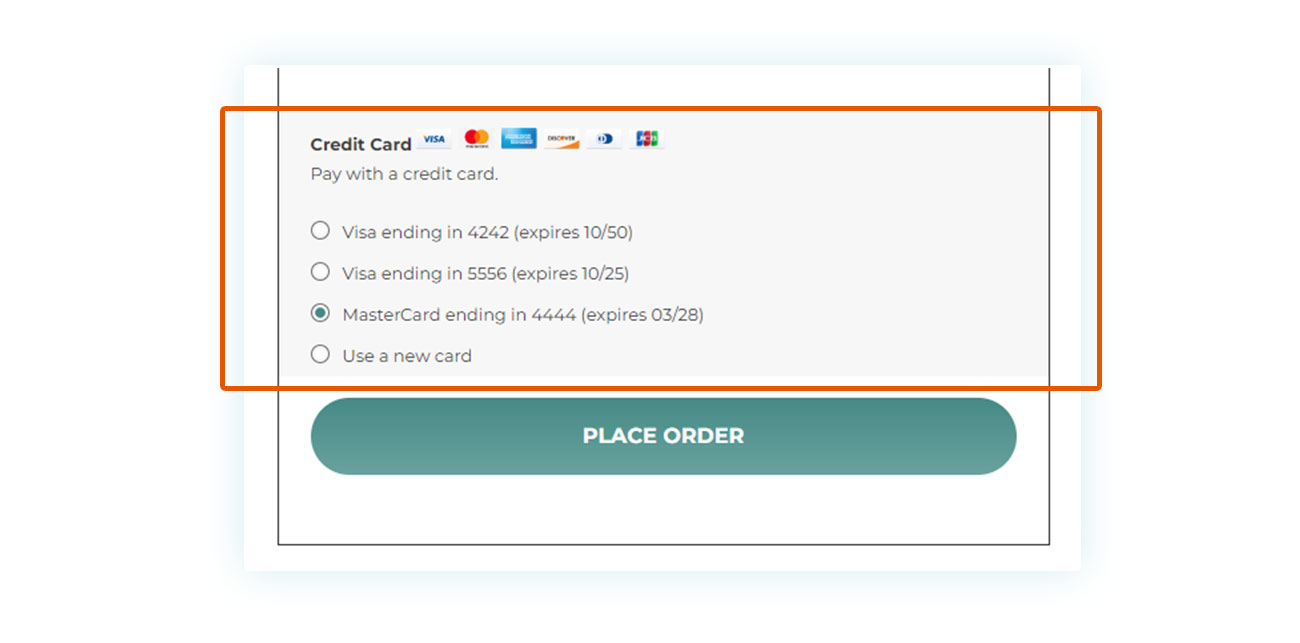

Once connected, you’re ready to start selling. The plugin also offers numerous customization features, including the ability to save credit card details to speed up subsequent payments.

Stripe is one of the safest online payment services available. But if you also want to integrate the well-known digital wallet PayPal, you will need another plugin (which uses Braintree – coming next!) to receive both payment by cards and via PayPal.

How to add Braintree payment gateway in WooCommerce

Stripe is the ideal solution if you want to offer credit cards on your eCommerce site. If you also want to offer PayPal, the Braintree for WooCommerce PayPal plugin allows you to get the best results.

This tool, in fact, allows you to add both payment methods within your store, managing everything through your Braintree account.

As with the Stripe plugin, using Braintree it is possible to save credit and debit card data, thus speeding up the entire checkout process for subsequent purchases.

While the option to save card data may not seem overly important, in fact, according to Bolt.com, 26% of uncompleted purchases at checkout are caused by the length and complexity of the process of customers typing in credit card details. So, anything that can simplify and speed up the purchase can lead to enormous benefits in terms of conversion.

The Braintree plugin also allows you to customize the PayPal buy button to better match the style of your site and is fully compatible with WPML.org, making it ideal for multilingual shops.

Just like Stripe, Braintree allows you – if necessary – to issue a refund with a single click. You also have the possibility to pre-authorize the transaction and charge the cost at a later time. (Many services use a similar process, including the mighty Amazon, which only charges at the time of shipping).

What is the difference between Braintree and Stripe in terms of how they enable credit card payments? The services are quite similar in that neither of them requires a monthly fee and both are supported by the percentage retained from your sales. Stripe requires a higher percentage but a lower fixed cost (2.9% + 30 cents), which is preferable in the case of many low-value orders; while Braintree goes in the opposite direction (2.59% + 49 cents) making it better for selling expensive products.

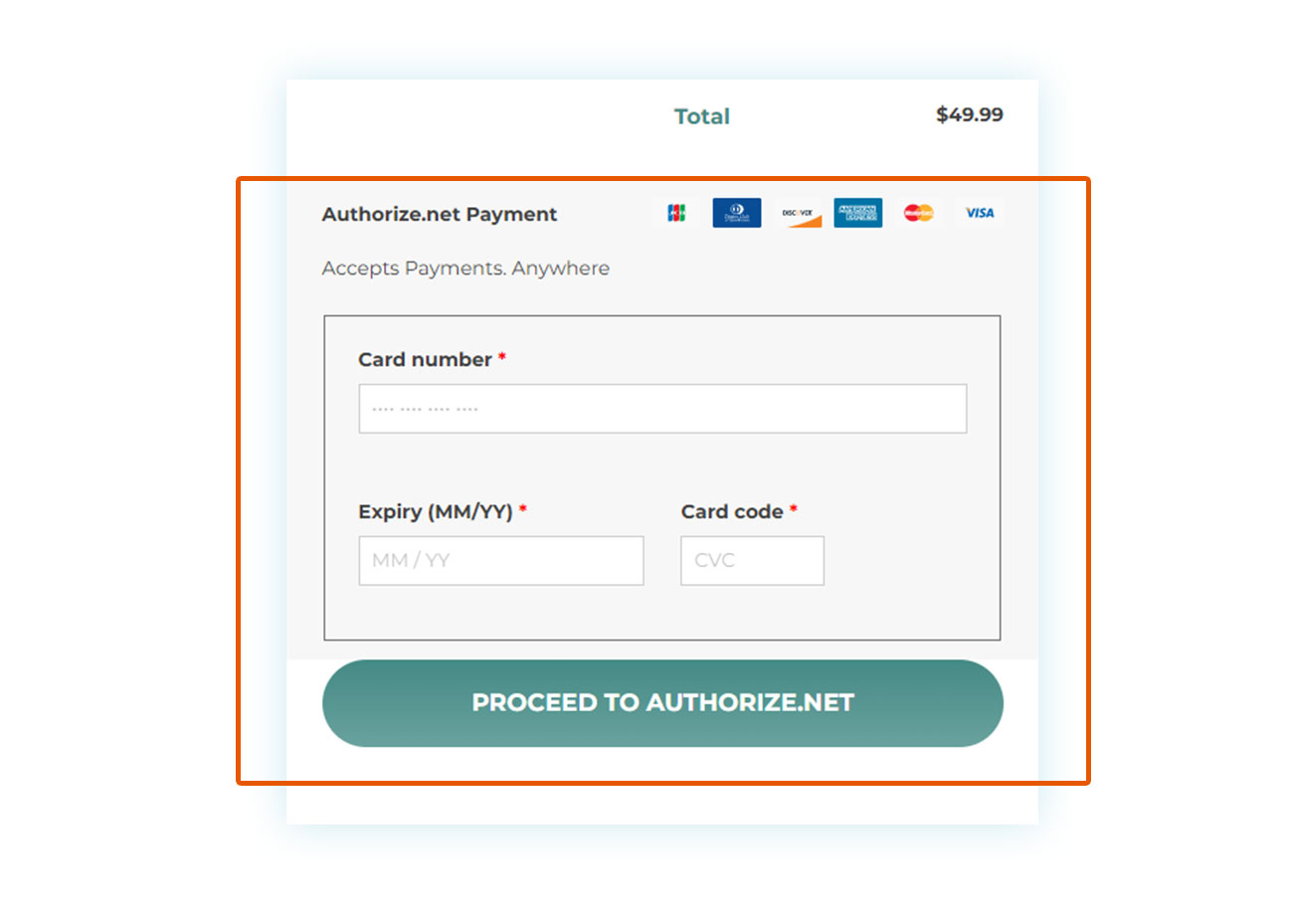

How to add Authorize.net payment gateway in WooCommerce

A third plugin to consider for credit card payments is WooCommerce’s Authorize.net Payment Gateway. Along with Braintree and Stripe, Authorize.net is also a service that acts as a bridge between the customer and the bank, allowing payment by credit and debit cards.

The functions are very similar to those we’ve already looked at for the other plugins. Authorize.net is generally very popular with international customers and is one of the most reliable services.

Once again, choosing one plugin over another comes down to the differences between the services: as with Stripe, Authorize also offers excellent technical assistance and reliability, but it comes with a monthly cost of around $25. However, Authorize is easier to use than Stripe, which is preferred by developers and engineers.

In terms of commission, the percentage and fixed cost that Authorize charges is identical to that of Stripe.

What is the best WooCommerce payment gateways?

To determine which WooCommerce Payment Gateway is actually the best, there are two factors you need to take into consideration. The first relates to the popularity of the method among your customers, while the second is the transaction fee (or authorization fee), i.e., the percentage that the service used will take from each of your payments.

Paying by credit cards and PayPal are the most popular and these are both must-have solutions for your online store.

Having said that, younger users and those more experienced with digital payments may also appreciate alternative systems, which are becoming increasingly popular. Among these, you can find Braintree, a digital payment service based in Chicago, and Authorize.net (another successful service based in the United States).

In general, it is good to offer as much coverage as possible: it’s better to offer customers a wide choice payment services than it is to lose sales because your site doesn’t have the preferred method for a specific customer.

However, you also need to keep the transaction fee for each service in mind. While cost-free for the customer, most payment methods charge the seller a percentage on each sale when they process payments.

This percentage is usually less than 3%, but it is not uncommon for it to be accompanied by a fixed fee, on average around 30 cents. (There might also be monthly fees). As you can appreciate, commission makes a big impact on low-value transactions, such as sales of inexpensive digital products. This means you should choose the method that allows your business to function without being penalized excessively at checkout. Keep in mind that there could be additional fees in the case of international payments.

Finally, while it’s important to look to the future of your eCommerce sales, it’s equally important not to offer too many payment methods. This can be distracting and confuse the customer during the most important moment for your sale: the checkout step.

For this reason, while it is essential to offer methods such as PayPal or credit cards, it may be a good idea to avoid too many unknown digital wallets in the country where you operate. You should even consider carefully offering systems such as Apple Pay or Google Pay.

Although purchases from mobile devices are growing, most online customers continue to prefer more traditional methods with greater security.

How can I make recurring payments with WooCommerce?

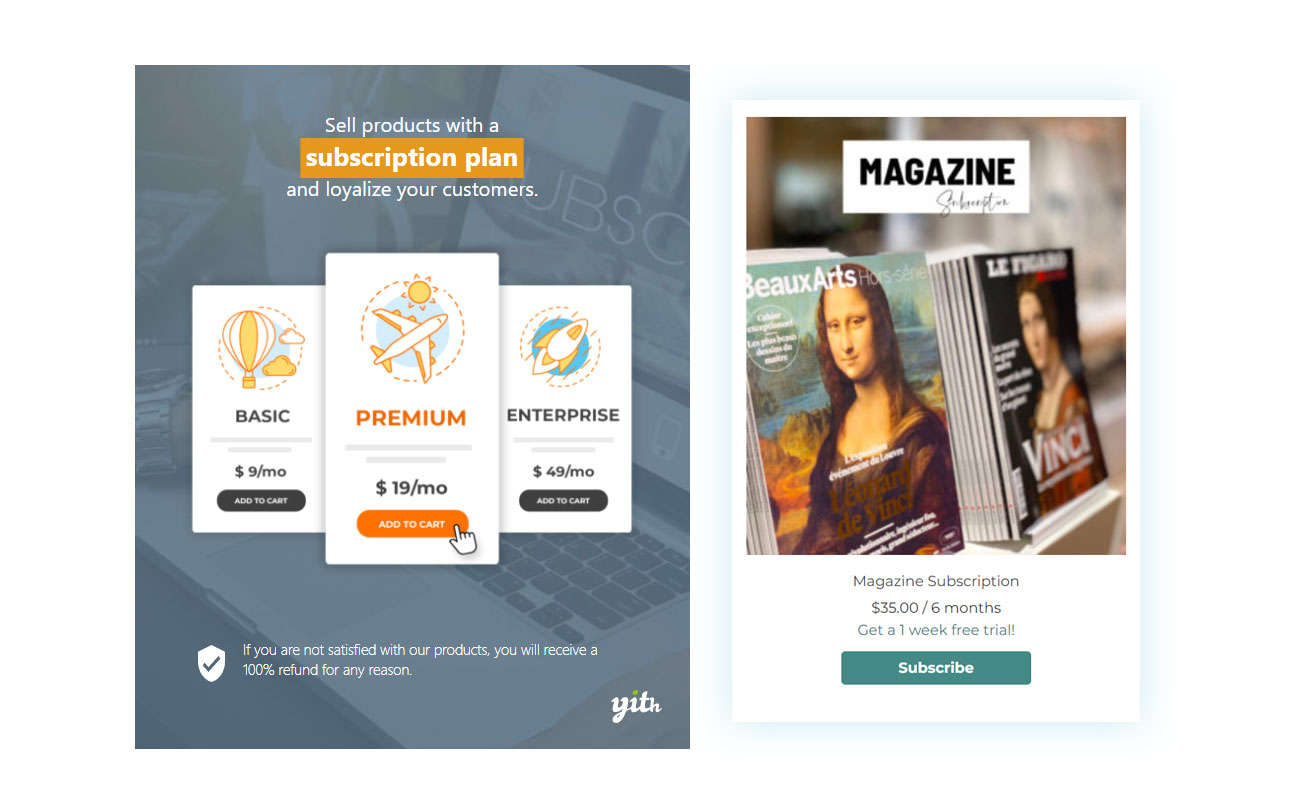

With regard to payment methods, there are some sales options that require specific gateways. Among these we can find recurring payments, or subscriptions that charge a regular amount to your customer.

Amazon Prime is a good example: users who subscribe to the service are charged every month or year in exchange for certain benefits. However, this payment can’t be made through manual systems such as bank transfer or cash on delivery: it must be linked to payments that can be verified automatically.

You should, therefore, first offer a payment process by credit card and then take advantage of a plugin called WooCommerce Subscription, which allows you to create recurring payment plans that can be purchased by your customers.

Furthermore, by combining this plugin with WooCommerce Membership, you will be able to offer exclusive content to users who sign up for membership, including access to certain areas of the site, products and services.Among the various functions introduced by Stripe within your online store, we should mention the Stripe Connect plugin. This tool has a specific function, which can be useful if you need to divide your income among several administrators. The plugin allows you to pay commission on sales to a third party, both manually and completely automatically. This allows you to share revenue between different partners. You also get the usual Stripe functions, such as the option to save credit card details.

How to add Stripe Connect payment gateway in WooCommerce

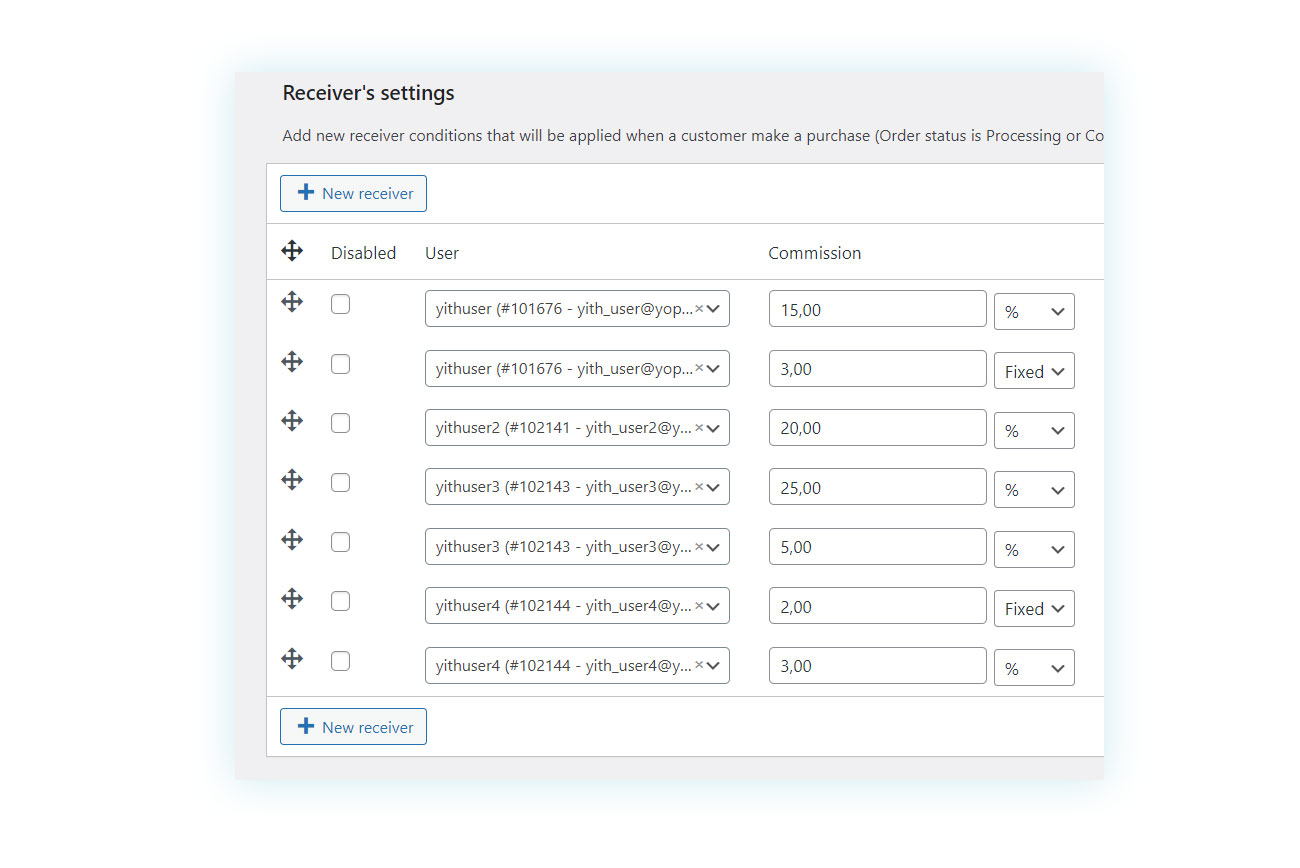

Among the various functions introduced by Stripe within your online store, it is right to quickly talk about the Stripe Connect plugin. the function introduced by this tool is very specific, but it can be useful for those who need to divide their income among several administrators.

In fact, the plugin allows you to pay commissions on sales to a third person, both manually and completely automatically, with the possibility, therefore, of dividing the revenue between different partners, as well as offering the typical Stripe functions (such as saving credit cards).

How to reduce payment gateway fees

As we have seen, the commission amounts requested by the various services are a very important factor for the seller to take into account, but there is a way to reduce these commission payments.

A premium accounts can lower commission costs, but only sellers with significant revenue should be advised to go for this more expensive option. A better solution for sellers with more modest turnover is to redirect the commission spend towards the customer.

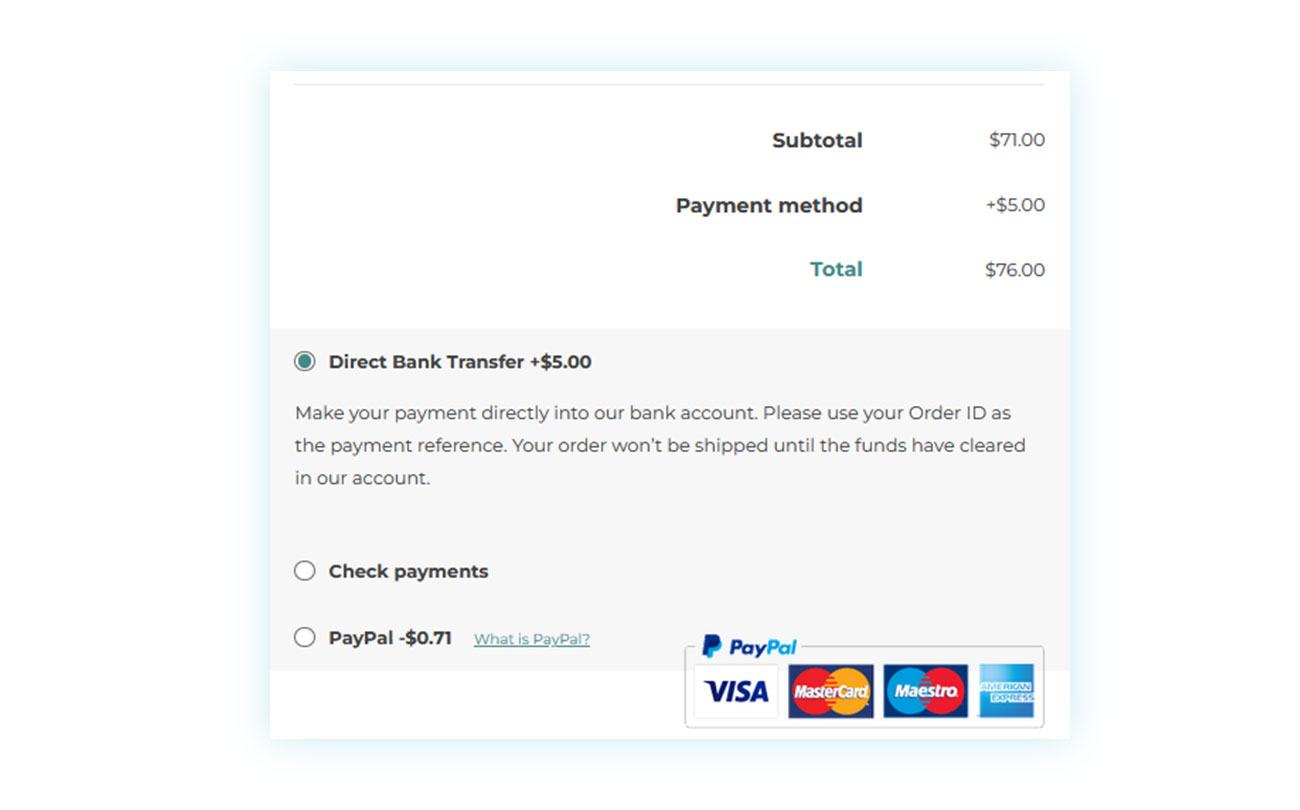

Using a plugin such as Dynamic Pricing for Payment Method for WooCommerce, you can achieve two important results:

- Add the cost of the commission directly to the checkout, so that the customer pays the commission and not you, the seller.

- Promote the use of more convenient solutions by pushing the customer towards making a certain choice, even offering discounts if one payment method is chosen over the other.

Even if showing the additional expenses leads to lower conversion, by combining a more expensive payment method with a cheaper one you can, in fact, increase sales, allowing you to save on the final commission (which obviously translates into a much higher income in the long term).

How to limit payment methods in WooCommerce?

We’ve already looked at how you can remove payment methods or add extra ones, but sometimes you need to strike a balance between the two. For instance, you may want to offer certain methods only for purchases of a particular value or based on the product’s price tag.

For example, if a payment method requires a 3% + 30 cent fee, you may prefer other solutions for low-value sales. To take a further example, if a digital product is worth $1, after deducting the commission, you would lose 33 cents – a third of its value!

To enforce these options, you will need a plugin called Payment Method Restriction for WooCommerce, which allows you (in addition to the functions listed above) to also choose which bank to use in the event of a transfer, so as to further reduce commission.

FAQ

How do I connect my payment gateway to my WordPress site?

Most payment gateways are connected via APIs, i.e. recognition keys available in the seller’s account (such as on Stripe) which allow you to directly connect your account to your eCommerce. In some cases, such as with PayPal, the connection between WooCommerce and the payment gateways is easier to implement – and often your email address is sufficient. Also remember that some payment methods, such as Apple Pay or Google Pay, are often integrated into the YITH WooCommerce Stripe plugin.

What is the best payment gateway for WordPress?

Both credit cards and PayPal are among the payment methods preferred by customers. For this reason, we recommend using a plugin such as YITH Braintree for WooCommerce that allows you to integrate both options. Then there are other payment methods that have grown in popularity, such as Bitcoin and additional digital currencies, but these are not used by the majority of customers.

How can I receive payment via payment gateway?

After processing payments, the method you use of withdrawing money depends on the system chosen by the customer. While PayPal credits your account immediately, other payment methods (such as Stripe) funnel payments into your personal e-wallet from which you can make a withdrawal later.

Is the payment gateway holding money?

Yes. Most digital payment methods charge a fee on the sale to the customer. Usually, a percentage of the value of the sale is requested together with a fixed fee of a few cents.

How Much Do Payment Gateways Charge Per Transaction?

The exact fee can vary, but it’s typically around 3% plus a fixed fee of 30 cents per transaction.

How can I avoid payment processing fees?

There is no direct method you can use in order to not pay the fee requested by the payment gateway, but you can use a plugin like YITH Dynamic Pricing to nudge customers towards certain payment methods or to charge the customer themself the fee requested by the payment gateways.

What is the safest payment gateway?

The issue of security is critical when it comes to payment gateways, as customers tend to choose the payment methods they trust the most. PayPal and credit cards are undoubtedly the safest payment gateways and it’s wise to offer multiple payment options via several payment gateways.

What are the disadvantages of payment gateways?

Being an essential tool for online sales, no seller can do without payment gateways. Despite this, the fee retained as a commission has a considerable impact on how you manage your online shop.

Conclusion

As you have seen in this article, sellers very often feel somewhat forced to opt for certain payment methods based on customer preferences and habits. However, this doesn’t mean that you have no choice in the matter. Using a dedicated plugin can help you increase the sales of your online store as well as provide additional features not included in WooCommerce.

Finally, when choosing between Stripe, Braintree and Authorize.net, you should take into account the service costs and commission rates in order to decide which option best suits your business flow.