Selling products and services within the European Union opens the path to several new markets that can certainly increase your shop’s revenue. To do it correctly, it is essential to comply with specific billing procedures that constantly evolve and may result in complicated management.

For example, from July 1, 2021, the previous laws changed again and the “OSS” (One-Stop Shop) procedure came into effect. This procedure is required for everyone willing to sell within the countries of the European Union.

According to this law, a company with a sale threshold under €10.000/year can apply the VAT of the country where it is based. Exceeding the threshold, the company must enable the OSS procedure which implies applying and paying the VAT of the customers’ country.

We have many customers who run e-commerce shops that are based in the EU, so we sprung into action to release an update of our YITH WooCommerce EU VAT plugin to include, in addition to general UX/UI improvements, all the options related to this new procedure.

Hence, from now, YITH WooCommerce EU VAT becomes YITH WooCommerce EU VAT & OSS: an unmissable tool for everyone selling through e-commerce within the EU.

What are the key features of this small and powerful plugin? Let’s see them at once:

1. Show and customize the VAT field at checkout

To make the billing process easier, the plugin allows adding the VAT field to the Checkout page to let companies enter their VAT. You can choose to set the field as optional or required to sell your products B2B only.

The check on VAT validity is made automatically and in real-time: the plugin validates the VAT number using the process of the official page of the European Commission, checking for the presence of the VAT number in the Intrastat records.

2. Import all the European taxes with one click

After configuring the correct taxes in WooCommerce, you are able to import them all into the plugin with just one click.

This allows defining the VAT to show when localizing the users and the countries to enable the VAT exemption.

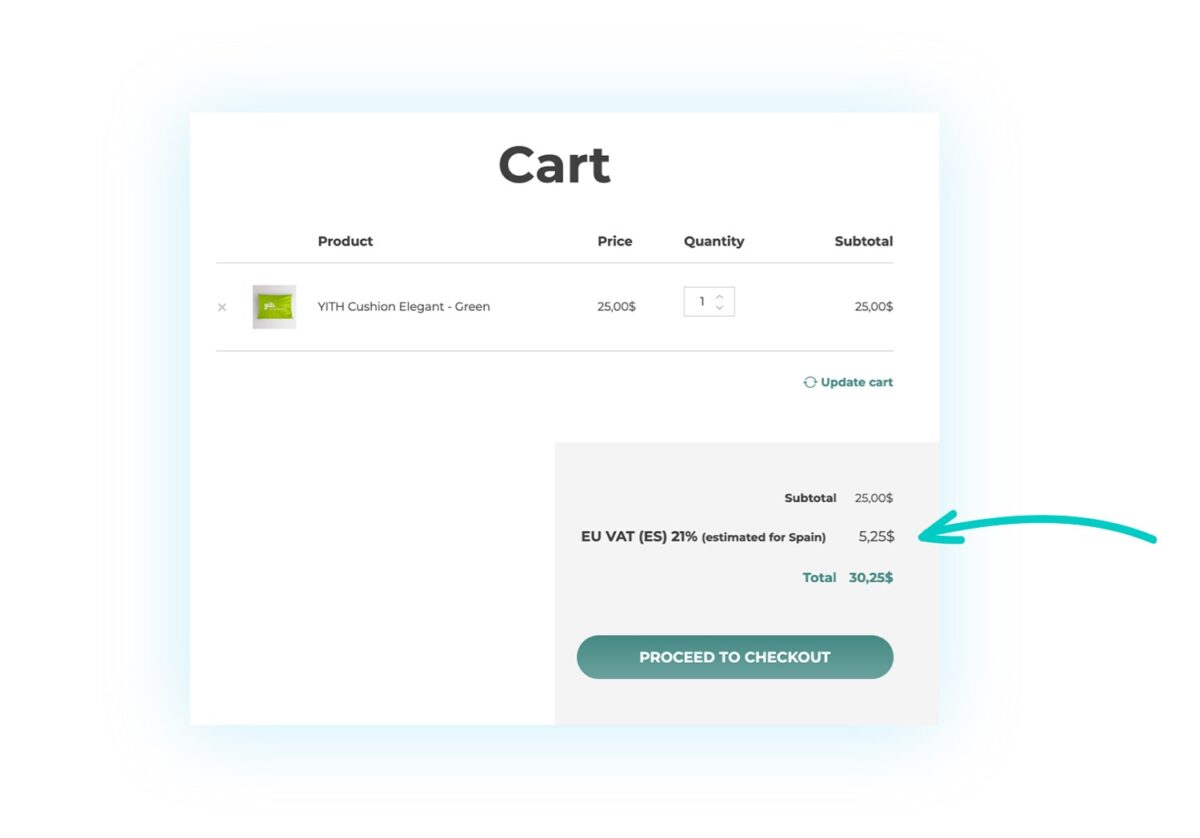

3. Geolocate users to show the correct VAT on cart and checkout according to their countries

Showing your users the correct VAT based on their country significantly reduces errors and improves the user experience by making tax fees on your shop always crystal clear.

If the country selected in the billing address doesn’t match the geolocalized one, the plugin enables to request the user an additional country confirmation.

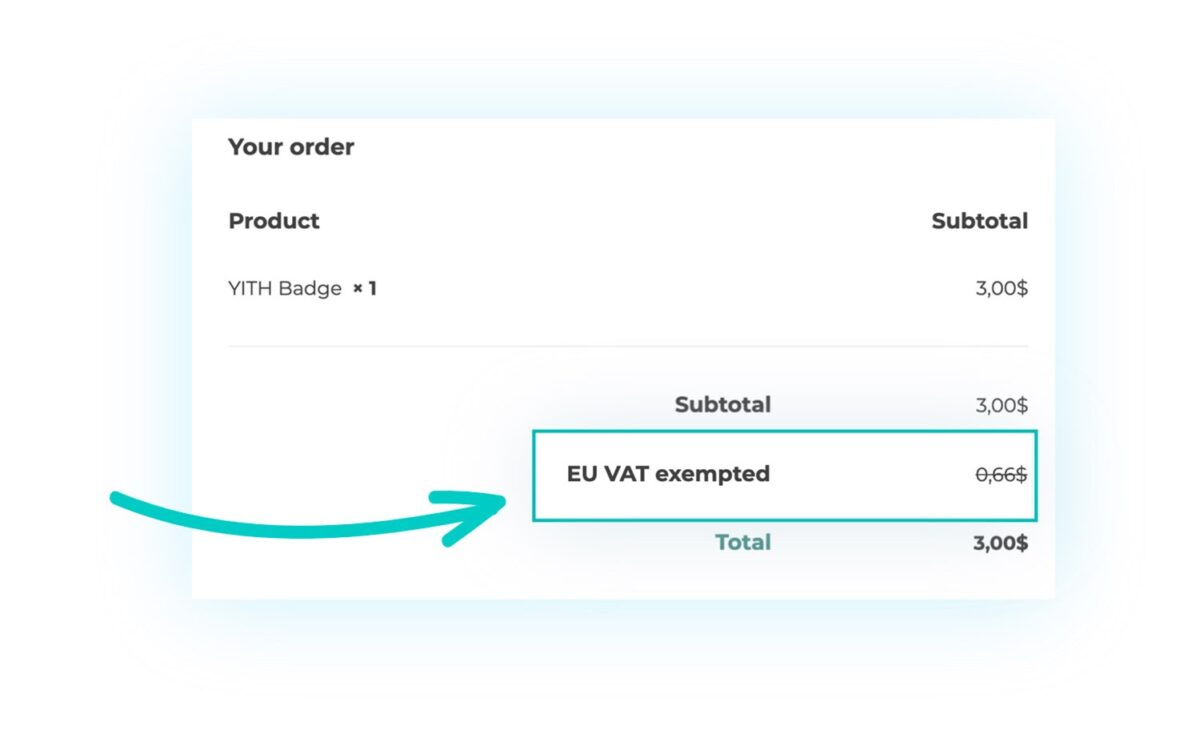

4. For B2B sales, allow companies to insert the VAT number to be exempted from VAT payment.

Allow the Reverse Charge procedure: companies from European countries who are registered for the VAT exemption can insert their VAT in the checkout page and, after validating the field, won’t pay the TAX for the order.

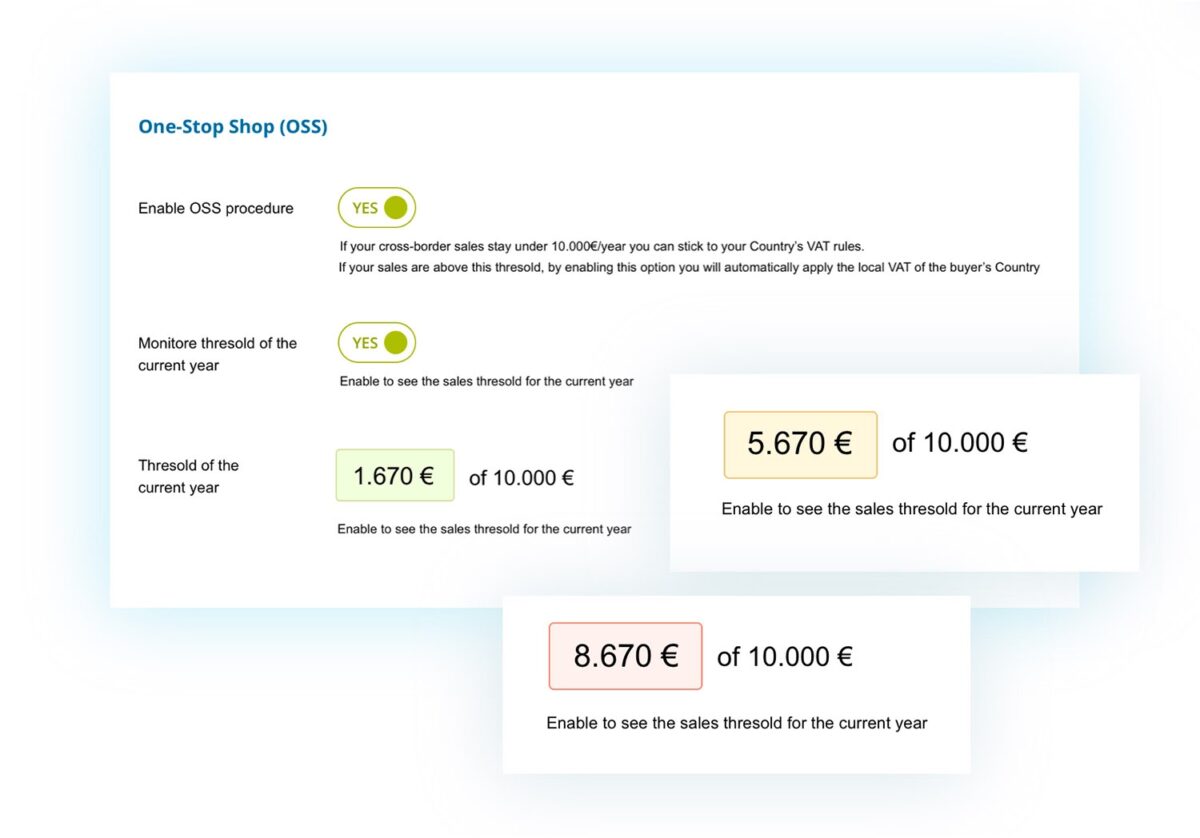

5. Enable the One-Stop-Shop procedure in just one click and easily monitor the €10.000 threshold

With just one click, you can enable the new One-Stop Shop (OSS) regime, required for all online retailers that manage EU sales from 1 July 2021. With this procedure, if your EU cross-border sales stay under 10.000€/year, you can apply your country’s VAT; otherwise, you must use the local VAT of the buyer’s country.

The plugin allows you to easily track the threshold, and while the amount achieved increases, it changes colors.

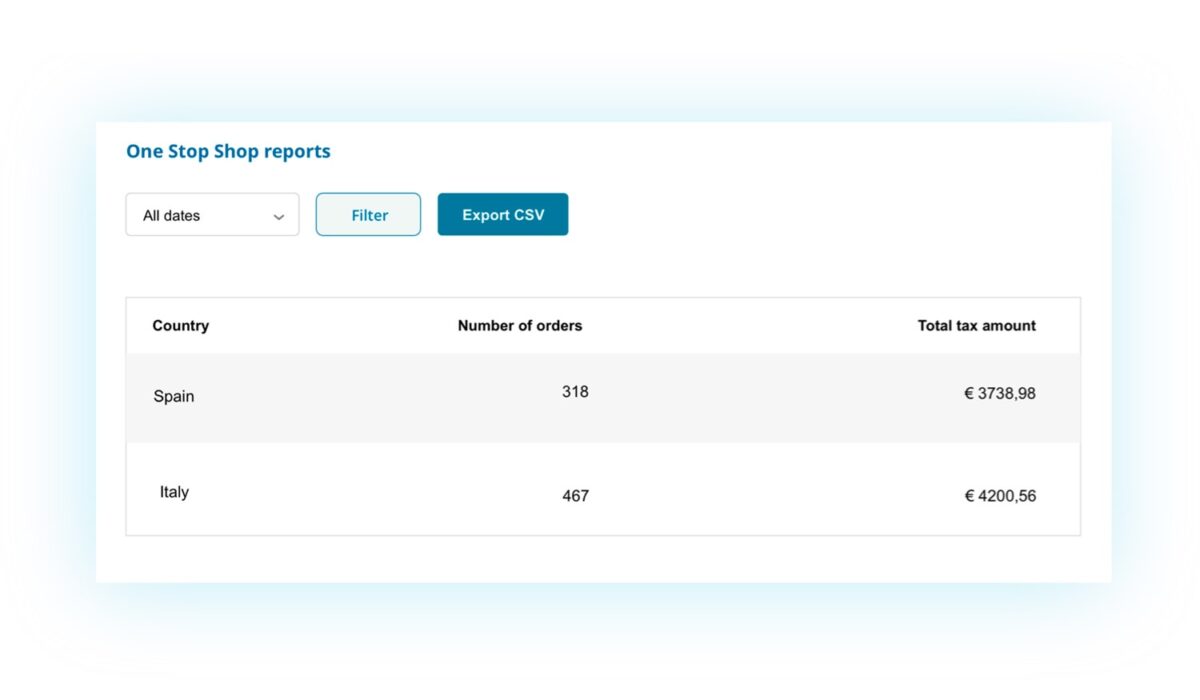

6. Automatically generate reports that can be exported into a CSV file to quickly update your records with the local tax authorities about your sales.

Enabling the OSS procedure, the plugin will automatically create reports (yearly, monthly, every 3 or 6 months, with custom dates, etc.) that can be exported into a CSV file to quickly update your records with the local tax authorities about your sales.

In conclusion

Why not find out more about your new VAT-ally to comply with EU sales?

Take a look at the plugin YITH WooCommerce EU VAT & OSS landing page.

Do you want to see the plugin functioning with your own eyes and check the available options in the panel? Use the new live demo of YITH WooCommerce EU VAT & OSS, where you will find the VAT filed at the checkout and be able to test the VAT validation of two different sample companies. Don’t forget to click on “Launch admin demo” to access the backend!

Doubts, questions, requests? Write them in the comments. Your feedback is always precious! 🙂