Many e-commerce companies decide to expand beyond their region. Selling products and services throughout the European Union can result in increased shop revenues and an opening to other markets.

But thinking about selling outside our homes it’s not enough. To do this efficiently, we must comply with specific billing procedures and e-commerce tax rules that are constantly changing and can be confusing. However, with an effective tool, this should not be a problem.

One of these tools is YITH WooCommerce EU VAT & OSS. A few weeks ago we celebrated a new update of our plugin and a change of name (formerly ‘EU VAT’, and now ‘EU VAT & OSS’). Why did we decide to make these changes? Because since July 1, 2021, the OSS (One-Stop Shop) procedure entered into force, changing the previous laws.

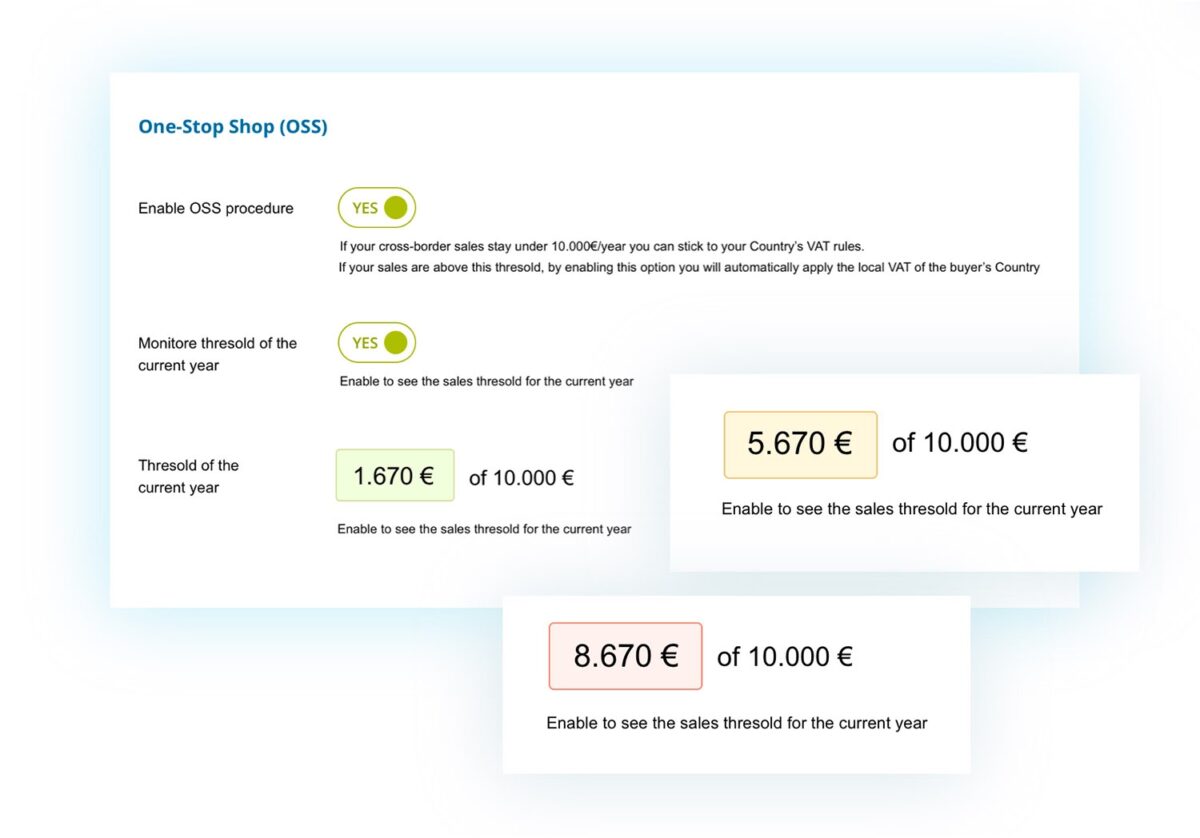

According to this law, a company with a sale threshold under €10.000/year can apply the VAT of the country where it is based. When exceeding the threshold, the company must enable the OSS procedure which implies applying and paying the VAT of the customers’ country. In addition, this is a mandatory operation for all those who want to sell in European Union countries.

As we have many customers who manage e-commerce stores in this community, we decided to include all the options related to this procedure in our product as well. If you want to know more about the update, you can visit this article where we talk in detail about all these issues.

How to activate the new IOSS functionality in EU VAT

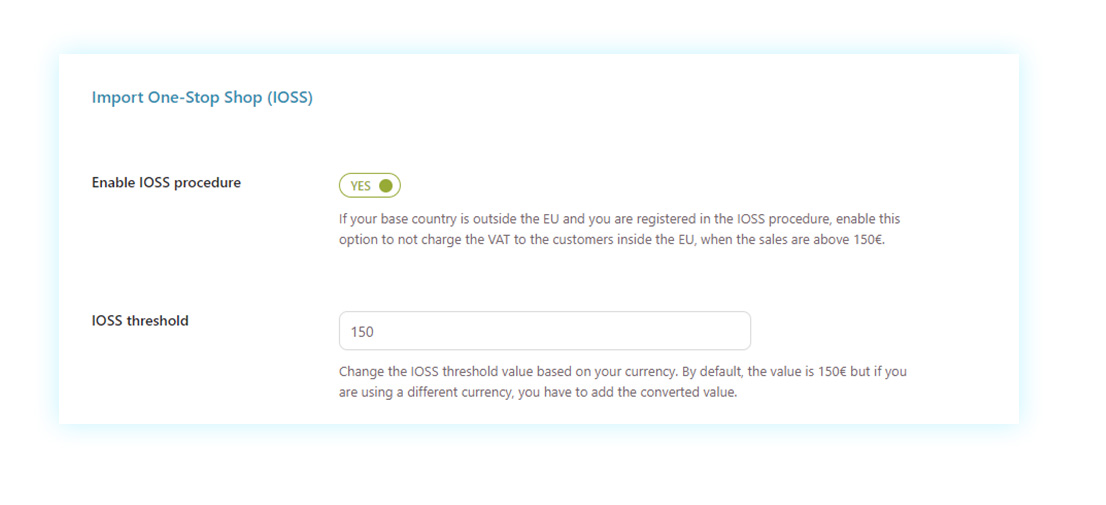

As we have already mentioned, these laws are constantly changing and recently another procedure has been added: IOSS (Import One-Stop Shop). This is a procedure created to facilitate and simplify the VAT payment for distance sales of imported goods with a value not exceeding 150€.

What did this mean? A new update of EU VAT, which has finally been renamed YITH WooCommerce EU VAT & OSS & IOSS. New functionalities were added which were necessary after the implementation of the latest procedure that you will learn about below.

Here are the new functionalities for YITH EU VAT & OSS & IOSS

What are the main features of this useful and powerful plugin? Two very simple ones:

1 – How not to charge VAT on EU orders over 150 Euro

Enabling the IOSS system in YITH WooCommerce EU VAT & OSS & IOSS is really easy. In the plugin panel, you will find an option that allows you to not include taxes to customers from the European Union when their orders exceed 150€, as long as your base country is outside the EU and you are registered in the IOSS procedure.

With just one click you can enable this powerful feature and keep your online store in order.

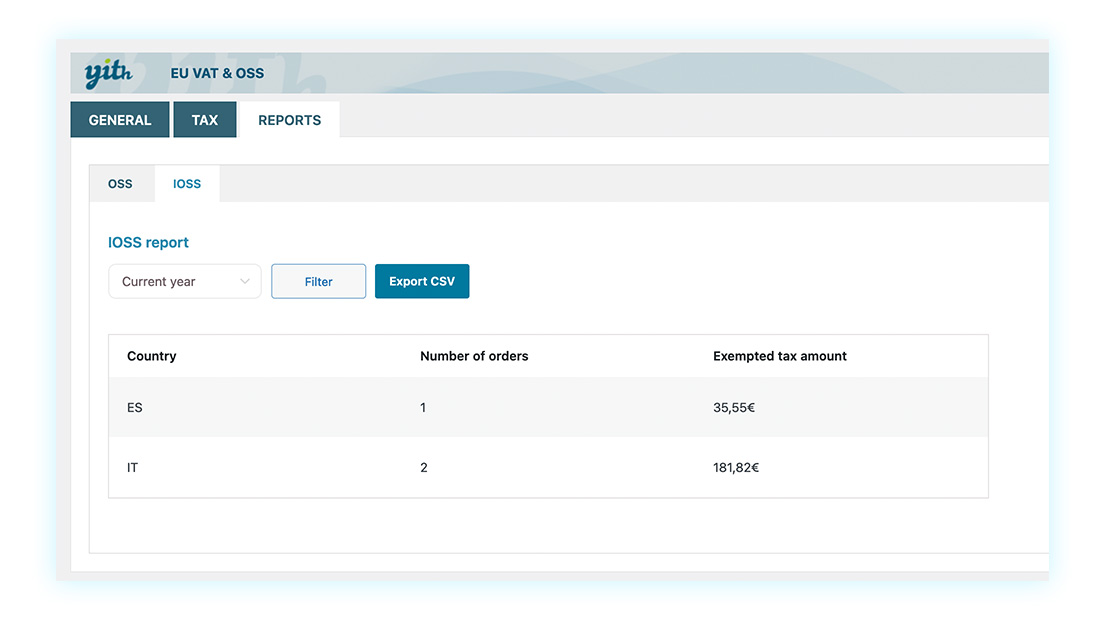

2 – How the new report for EU VAT works

But we didn’t only include the option to enable the latter procedure. As in the case of the OSS procedure, we have included an IOSS report section.

In the report, you can find the record of all taxes that have not been paid by the IOSS procedure. You can see the country in which the order has been placed, the order number, and the amount of exempted tax. As in the case of the OSS report, it can be possible to export the content in CSV format.

In conclusion

As you could see, these two new features are very simple to implement and understand. Plus, hey will keep your online store updated according to the specific billing procedures and VAT rules in the European Union. Remember that we wrote an article about the previous update that can be very helpful.

Want to know more about this plugin? You can visit its landing page here.

Also remember that if you want to see how it works, you can use the new YITH WooCommerce EU VAT & OSS & IOSS live demo.

As always, we’d love to read your comments about this plugin. We are very proud of these additions, what about you, do you have any doubts?